Digital feature: long read

Pork & bacon: a pig of a year, yet opportunities remain

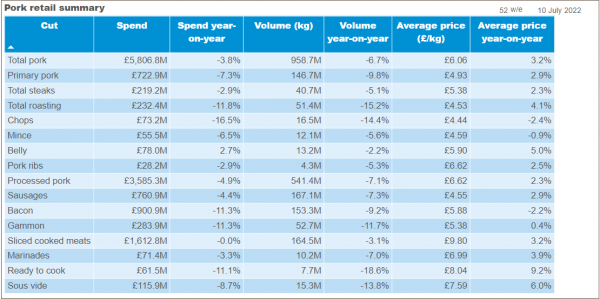

The top line data paints a sobering picture, as the table below outlines. According to Kantar, in the 52 weeks to 10 July, retail value sales across almost all categories fell. Pork belly was the only winner. Volume sales were down across the board, with ready-to-cook, roasting joints, pork chops and sous vide hit by the biggest declines. According to levy body AHDB, volume sales of leg and shoulder joints, the go-to areas for dinner parties, declined significantly. Similarly, total pork sales declined in value and volume terms. Bacon was the biggest casualty.

"Despite sausages and bacon being seen as highly enjoyable and practical, and a staple during the pandemic, both categories have lost shoppers and frequency in the last year," AHDB comments in its July pork market outlook.

However, viewed with a perspective that stretches further back, pork has been the only red meat to resist flagging and maintain the same level of UK retail value sales across the 12-months in comparison to 2019. And the dreaded COVID effect distorted 2020-2021 sales as consumers drew much more on the retail sector and home cooked meals while the foodservice channel remained closed. Restaurant and hospitality sales began opening back up in 2021-2022, so sales ebbed out of retail towards that sector once more. This might be seen as a positive for UK producers were it not for the fact that, as Rebecca Veale, senior policy adviser at the National Pig Association, says, most pork sold through UK foodservice is imported.

Steaks and mince grow

The latest 12-week snapshot is not quite as bleak. Value sales to the 10 July for pork steaks grew in the strong single digits, while mince delivered strong double-digit growth. AHDB observes: "Total steaks have experienced slight volume growth in this data period and volume gains for mince accelerated as more shoppers bought this product, most likely driven by a significant increase in promotional activity."

Of course, the cut off for this period comes just before July's mini heatwave from 16-19 July, so it remains to be seen how much this and any subsequent warm weather drives up sales of barbecue products.

The tricky bit is food-to-go, which continues to be hit by people working from home. The drop in commuters grabbing sausage rolls and bacon baps on the hoof has taken its toll. In addition, with potentially the worst of the cost of living crisis yet to come as inflation continues to rise, and energy bills set to spike again in October, AHDB predicts food-to-go processed pork sales - dependent as they are on discretionary spend - will continue to suffer. "Takeaway/delivery remains a positive for the sector and continues to grow in the last year for pig meat, up 20%. However, AHDB estimates that for total out-of-home, volumes are still down 8% on 2019 levels.

"Consumer spending ability is going to dictate behaviour going forward. This will not only impact retail but will also slow down the out-of-home recovery as 36% claim they are planning on eating out less, with money saving being the top reason for this [AHDB/YouGov Tracker, May 2022]."

That said, Rachel Griffiths, chief commercial officer at pork producer and processor Pilgrim's UK, is upbeat: “As inflation continues to bite, we expect to see more at-home occasions resume, as people turn to scratch cooking. Pork provides consumers with a good value, tasty alternative as they look for healthier and more inspiring recipe ideas. Our Slow Cook and Ready to Cook categories performed well during lockdown as consumers looked for ‘dinner for tonight’ options. We also expect to see our premium pork products continue to rise in popularity as they provide a great quality, affordable alternative to meat categories like beef."

Pig losses

Pig producers struggled towards the end of last year and the start of this year as production volumes fell as a result of a shortage of labour in primary and secondary processing and input costs continued to rocket, exacerbated by the impact of the Ukraine conflict on feed supplies. This led to an estimated average net loss of £58 per finished pig in the first quarter of 2022. Veale says: "Pig producers have been losing money for seven consecutive quarters now."

That said, the recent rebooting of grain supplies from Ukraine may ease feed costs and the labour crisis has eased slightly, although it remains a concern, according to Veale. "The labour supply in the slaughter sector is stable currently. We understand recruitment is ongoing and costs remain very high for those recruiting foreign labour – it is not just the cost of recruitment but sourcing subsequent housing, transport and encouraging community integration."

As AHDB states, pig meat production in the first five months of this year was 452,000 tonnes, 6% higher than at the same point in 2021, mainly driven by heavier carcase weights - a legacy of the processing backlog. Griffiths says: “We continue to focus on mitigating the impact of labour shortages on our sites and have removed the much-publicised backlog of pigs on our farms, resulting in record numbers of pigs being processed. We are working with Government and industry bodies to seek greater access to labour."

While pig weights currently remain substantially above last year’s levels, they are falling as the production bottleneck clears. Given the decline in the sow herd recorded in Defra data, and other indications of a reduction in servings, the drop in clean pig supplies will at some point outweigh any remaining backlog, so clean pig slaughter is expected to fall substantially in the second half of the year. AHDB therefore predicts that across 2022, pig meat production will fall by 6% compared to 2021, to around 970,000 tonnes, and by a further 9% in 2023.

Rising pork prices

Rising UK pork prices could be seen as positive, but in reality it's a mixed blessing, weakening some of the appeal of pork as a cheaper meat option for domestic shoppers.

Export markets offer a rosier picture for some. Weak demand from China is not expected to recover dramatically, but AHDB still expects overseas sales to grow by 7% in 2022 over 2021 levels, while remaining below 2020 levels. It recently hailed strong growth from the Philippines, where UK exports reached almost £17m in the first four months of 2022 – up 14% on the same period last year.

According to the latest figures from HMRC, between January and April, the amount of pig meat shipped to the country in Southeast Asia increased 46%, to 13,812 tonnes. The Philippines is now the UK’s second largest non-EU pork export market, behind China. Last year, almost £38m worth of pork was shipped there – a fourfold increase on 2020.

Chile

And on 2 August, the UK's largest pork processor Cranswick revealed it was preparing the first shipments of British pork heading to Chile. The consignment will leave its plant in Preston, Hull, early next week following a new agreement announced in March granting market access for 27 pork processing sites in the UK, enabling the first ever UK pork product exports to the country. AHDB estimates the market could be worth up to £20m over the first five years of trade.

A spokesman from Cranswick said: “As the largest processor of pork in the UK, it is imperative we continue to have access to new and emerging international markets, and we welcome this access agreement between the UK and Chile. We continue to work closely with AHDB to identify and develop new market opportunities.”

Griffiths is less optimistic about China. "One issue which sits entirely outside of our control is our inability to export product to China. This is having a direct impact on the number of pigs that can be processed. This is because carcasses exported to China require less skilled butchery, therefore allowing for greater numbers to be processed through the sites even with fewer butchers available.

“This export constraint currently affects over one third of all pigs processed in the UK. It is all the more frustrating when UK industry is desperate for exports in a post Brexit and pandemic era. Pork exports from the UK have reduced by 12.1% over the last 12 months, which is largely as a result of the China export licence suspensions that have been in place since 2020. We are working closely with the government to encourage the Chinese authorities to reinstate export licences, and are looking to develop new markets across the world for our high-quality British pork products.”

AHDB is more positive about the China effect: "On the whole, much of the pork that had been exported to China by the UK and EU over the past couple of years is expected to find demand closer to home. EU and UK consumers have eaten this pork before, and all other things being equal, can do so again."

As if the rollercoaster of all these factors wasn't enough, behind it all the spectre of African Swine Fever (ASF), which has established a presence in Europe, continues to be a huge worry for UK pig processors. "The risk of ASF remains at medium, which is the highest it can be without disease in the country," Veale says. "However, the risk from human-mediated pathways has been raised to high due to the recent jumps of disease in Germany and Italy which are believed to be linked to humans.

African Swine Fever

"NPA is incredibly concerned because an ASF outbreak would not only affect the health and welfare of our pig herd, but also cause huge disruptions to industry and there are big implications for trade – we rely on our export market for carcase balance ... Classical Swine Fever in 2000 and Foot and Mouth Disease in 2001 cost the UK an estimated £3.5bn. ASF would decimate the domestic pig sector."

Given the risk, the NPA, AHDB, Pig Veterinary Society and others continue to press producers and wider industry to embrace good biosecurity practices to prevent the disease from affecting their herd. Relevant stakeholders continue to lobby Government to put in place more robust border checks to prevent ASF, or other pathogens, from entering the country in meat or animal products. "The further delay to checks which were due to come into force in July 2022 are putting the UK pig herd at greater risk," Veale says.

So far, there has been little practical progress on the UK's Border Operating Model or, for that matter, ensuring smooth trade in harmony with the Northern Ireland Protocol, she adds. Given the potential supply chain disruption risk from these two things, she concludes: "We understand that work continues in Whitehall, but both of these issues are of great concern to NPA and the pig sector. These need to be addressed by the new Prime Minister as a matter of urgency."

However, on 15 July, the Government did launch a review of the pig sector, which will run until 7 October 2022, to increase fairness and transparency in the industry. It is seeking views from pig farmers, abattoirs, processors, retailers, marketing groups and all stakeholders involved in the pig supply chain on issues such as transparency, price reporting, clarity of contractual terms and conditions, and market consolidation.

Business development and innovation

None of the challenges faced by the UK pork industry have prevented business development and innovation at major pork processors though.

In its latest trading update for the 13 weeks to 25 June 2022, Cranswick reported trading revenue was 7.6% ahead of the same period last year.

Pilgrim's UK's Griffiths says. “Protein snacking is a key category for us, and one which is currently seeing strong growth. As people spend more time on-the-go we are seeing a greater level of engagement for lunchtime occasions.

"We worked with Waitrose to launch an own label range of bacon made without nitrates. Available in both Smoked & Unsmoked SKUs [stock keeping units], the process uses a blend of natural ingredients, without compromising on any of the quality attributes which consumers know and love about their bacon. The range is already available in store now and performing well.”

Free from nitrates and nitrites

Nor is Pilgrim's UK the only UK pork processor to offer bacon free from nitrates and nitrites, an area of contention that surfaces periodically due to the link some studies make between use of the preservatives and increased risk of some forms of cancer. Cranswick, Karro Food Group, Oscar Mayer and of course Finnebrogue all offer similar options.

It remains an area offering opportunities not just for processors, but also for ingredients suppliers. In May, Givaudan introduced NaNino+, a patent-pending synergistic combination of plant-based ingredients and natural flavourings that can be used as a nitrite replacement in processed meat.

Guillaume Gaborit, global product manager for sense preservation at Givaudan, said at the time: “Because nitrites provide multiple benefits, replacing them is no easy task. Alternative solutions must provide the same level of performance without the associated risks. This is what sets NaNino+ apart: it’s an integrated solution that not only ensures freshness throughout shelf life, but also delivers a cured-like multi-sensory experience in terms of taste and colour. This compelling combination provides high performance in the application itself and may allow for a 'nitrite-free' claim on the label.”

NaNino+ is the latest addition to Givaudin's existing clean label curing solutions. Available initially in Europe for emulsified cooked sausages to start, expansion to other applications, such as cooked ham and bacon would follow, it said. Givaudan said it could tailor these solutions to local regulations and consumer preferences.

Given the struggle faced by UK pork processors, it's heartening to know innovation and success, both overseas and domestic can still be achieved.

AHDB's tips for pork success

The pork outlook might be mitigated, if the industry:

- plays on value for money for those whose financial situations are suffering;

- encourages consumers to treat out-of-home. Opportunities in the eating-out market include personalisation, indulgence, quality cues and pushing reputational factors such as health, sustainability and backing British;

- encourages shoppers in-store by improving the experience of the meat aisle;

- continues to innovate: in retail, to tap into demand for big seasonal events such as barbecues and Christmas; out-of-home processed should capitalise on the takeaway/delivery trend; in foodservice, primary pork needs a greater share of dine-in menu space in establishments like pubs;

- addresses health concerns by communicating the health benefits of pork such as B12 and iron;

- in the longer term, looks to maintain and build consumer trust, demonstrating where farming values (animal welfare, environmental stewardship and expertise) are shared with consumers.