Feature

Food and drink reformulation: the story so far

As defined by the World Health Organization (WHO), reformulation is the process of “altering the processing or composition” of food and drink products “to improve its nutritional profile or to reduce its content of ingredients or nutrients of concern”.

There have been several drivers for reformulation, including rising costs, health and consumer preferences for ‘natural’ propositions, alongside legislative ruling such as the beverage sugar tax and more recent high in salt sugar and fats (HFSS) regulation.

Higher price points drives reformulation

Just as the higher prices have influenced gas and electric bills at home, we’ve also seen factories effected by rising energy prices and climbing raw material costs – and this has necessitated a creative response among food and drink producers.

While plants have opted for technology and green switches to accommodate for expensive energy bills, reformulation has also played a big part in lowering costs.

Speaking with Synergy Flavors’ Vicky Berry, who acts as senior European business development manager, she noted a trend in re-balancing recipes with less expensive ingredients to keep costs down.

Offering an example, she explained that as a result of fructose doubling in price, drinks producers are shifting back towards sucrose, and other sweeteners or taste modulation solutions.

Less salt, sugar and fat but still tasty

While re-balancing recipes with less expensive ingredients can help to keep costs down, Berry affirms taste remains king.

“Consumers won't compromise on taste – flavour solutions can therefore be used to help maintain taste, mouthfeel and aroma, providing manufacturers support in reducing or mitigating cost,” she said.

Using the ready-to-drink (RTD) category as another example where premium taste is a must but margins tight, she explained that “authentic alcohol flavours” can help to build back the complexity and authenticity in the absence of more expensive spirts like tequila.

Indeed, the ingredients company has seen more flavours and taste solutions being used to mitigate against reformulation challenges such as off-notes or texture issues.

“Dairy flavours such as butter or cream can be used in bakery and dairy products to enhance desirable attributes such as creaminess and authentic dairy taste, despite reduced quantities of these sometimes expensive ingredients,” Berry offered.

As of 2022, Danone UK & Ireland has achieved a 21% reduction in sales weighted average total sugars, compared to 2015, across its yogurt and plant-based alternative to yogurt portfolio.

Reflecting on Danone’s work in reformulation, head of nutrition and science communication, Zoe Ellis, said that while it has achieved impressive reduction results, it was not an easy task.

Ellis added: “Decreasing the amount of sugar too much, too quickly can result in consumers not enjoying the product as much. Instead, they could end up turning to a less healthy alternative.”

Along with taste, components such as salt, sugar and fat play a key role in areas such as shelf-life, texture, structural stability and the visual appeal of a product, so tweaking levels is a tricky tightrope to walk.

As a result, Danine is continuing to explore innovative ways of reducing sugar further in its non-HFSS yoghurt range, whilst maintaining these elements.

In response to the taste issues that may come as a result of reformulation, Synergy Flavors has developed a range of masking flavours to help alleviate the undesirable notes associated with popular plant-bases such as soya.

“By understanding the chemistry of the protein bases and what chemical compounds are responsible for certain aromas, our R&D team can work out the best flavours to counterbalance and complement the base properties,” commented Berry.

“We’ve also had a strong focus on taste modulation solutions, and our sweetness modulators are popular with manufacturers looking to achieve their reformulation goals.”

Health and function

While successful reformulation is no easy feat, switching up ingredients can offer other opportunities, such as greater product perceived value.

The demand for functional food and ‘natural’ claims has been a trend on the up since the pandemic – and this was evident at the most recent FiE event in which exhibitors were focused on both. In response to this trend, many brands have launched or reformulated products to include such features, such as natural-named flavours or sweeteners – and we can expect them to continue to do so in 2024.

Referencing Innova’s 2023 report exploring ‘health boosting delights’, Berry said as many as 28% of respondents would pay more for a product with functional ingredients that boost physical health, and 20% said yes to more premium prices for products that enhance mental health.

However, it’s worth nothing that between the claims of ‘functional’ and ‘natural’, the latter wins.

“Innova [2024 research] reports that, when asked how to make food and beverages healthier, 35% of respondents said ‘use natural ingredients/less artificial ingredients’, which was over three times higher than respondents who stated ‘adding functional ingredients’. This highlights the importance placed on natural cues,” Berry added.

Further citing from Innova’s 2022 research, she explained that data has shown “authentically natural flavours” to be considered more important than product origin even.

In response Synergy has expanded its range of natural-named and depictable flavours, developing new kiwi, cherry, apple, pineapple-coconut, mango-passionfruit and blackcurrant flavours for manufacturers to tap into.

Meanwhile Danone has made a series of health-related commitments this year. This includes a promise of 90% of its portfolio by sales volume to be rated as ‘healthy’, receiving a score of at least 3.5 stars out of 5 within the Health Star Rating index.

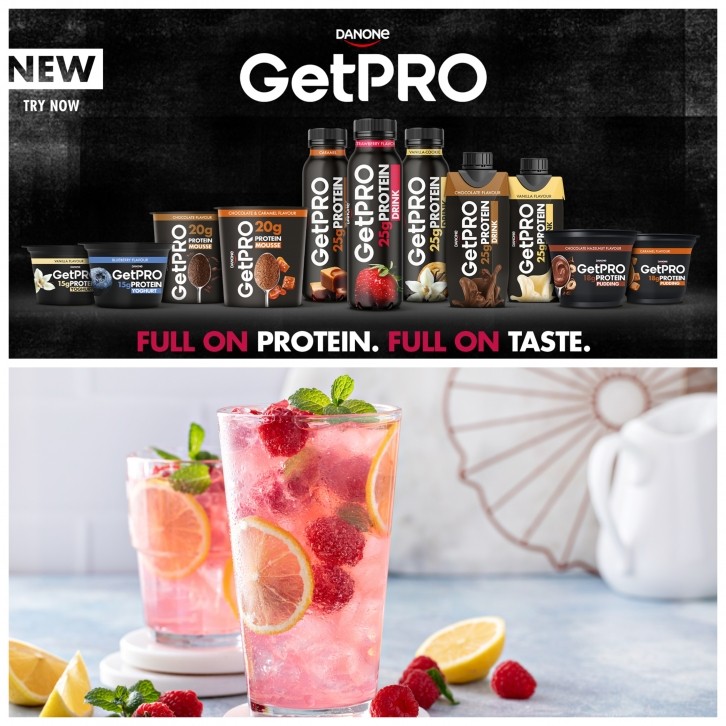

Alongside a high protein yoghurt range, GetPro, which came out in September, boasting low or zero percent fat and no added sugars, this summer also saw the brand launching Actimel Plus. These shots contain 100% of the EU reference intake of vitamin D, plus a source of vitamins B6 and B12 alongside exciting flavour twists.

With vitamin D deficiencies rife across Britain, this product provides a way to address that gap.

Similarly, Danone has also been responding to the UK fibre gap, with the summer also seeing the roll out of its Activia Fibre product. Alongside calcium and live cultures, the sub-range of the brand’s gut health yogurts includes cereals and nuts to improve the quantity of fibre in the product. Each yogurt contains nearly 10% of the recommended daily intake of fibre.

“Our new Activia Fibre range comes at a crucial time in the industry following the paucity of fibre intake amongst UK adults, with research suggesting that 91% of people don’t eat enough fibre in the UK,” explained Ellis.

Are we paying enough attention to salt?

For Caroline Klinge, director – Klinge Chemicals Ltd, however, salt is the biggest health issue in need of addressing.

“We know about the UNSDG set in 2015. There's 17 goals that are supposed to be a blueprint to achieving a better and sustainable future for all, and we are particularly dialled into goal number three being good health and well-being. Within that goal there is target 3.4, which aims to reduce premature mortality and non-communicable diseases (NDCs) [e.g. cardiovascular disease] by a third by 2030,” she explained.

“NCDs are responsible for 71% of all deaths, killing 41m people globally each year – an estimated 8m of those deaths are associated with poor diets, of which 2m are purely attributable to high sodium intakes.

“Salt is our biggest source of sodium. But if you reduce the amount of sodium you consume, you will reduce your blood pressure and therefore your risk of developing an NCD. But sadly, as the WHO’s global report on sodium reduction launched in March this year said, we're a long way from achieving this target.”

Klinge Chemicals is the manufacturer of LoSalt – which is a blend of two mineral salts, two thirds potassium chloride and one third sodium chloride.

“We don't engineer the salt out of salt. We just take two different mineral salts that are mined from the ground and combine them,” Klinge added.

For their salt reduction programmes, food manufacturers can either use a salt alternative such as LoSalt, or they can partially substitute their salt with potassium chloride, she told Food Manufacture. So the Scottish-based company sells both potassium chloride in bulk and produces LoSalt.

Whilst many reading this might question using potassium chloride due to its naturally bitter, metallic taste, Klinge assures this has been addressed.

“We match the crystal size of potassium chloride with sodium chloride, which allows us to get a homogeneous blend on mixing and a close flavour profile match,” she explained.

And the response from customers has been wholly positive, with three out of four people trying LoSalt and liking it, with a 94% likelihood of a repeat purchase. For Klinge, the big issue is that salt is intrinsically linked with flavour, with consumers associating low salt with low flavour.

That perception is changing though and LoSalt’s acceptance is helping to rewrite the narrative. One notable British bakery chain is now highlighting LoSalt on its back of pack. While it’s not something the bakery is ‘shouting about’, it’s progress nonetheless and a nod to LoSalt’s reputation.

But there are brands starting to push low salt products generally in a more open manner, with Walkers, for example, releasing crisps emblazoned with 45% less salt on front of pack.

This being said, Klinge is adamant that reformulation isn’t enough. “Salt consumption is still going up – ever since the salt targets were taken out of the control of the Food Standards Agency (FSA) and put into the Department of Health, and hidden in the responsibility deal. The responsibility deal at the end of the day is a voluntary thing, and when something's voluntary, people tend not to do it.”

She cited the downward trend in salt consumption between 2013 and 2016 when the salt reduction programme was in place in the UK.

“It has to be in the public psyche to want to reduce, to make any difference,” Klinge noted.

Regulation and reformulation

Whilst there have been a few voluntary initiatives for salt and sugar, we also saw regulatory changes brought about by the 2018 Soft Drinks Levy (‘sugar tax’) and the more recent High in Fat, Salt and Sugar (HFSS) regulations announced in 2020.

The former regulation, announced back in 2016, aimed to reduce sugar in soft drinks containing added sugar, such as fizzy beverages – and research suggests it did make an impact. One study, as cited by the World Cancer Research Fund International, found positive associations between the levy and a reduction in obesity among girls aged 10-11.

Research led by the Medical Research Council’s Epidemiology Unit at the University of Cambridge also estimated that around 5,000 cases of obesity per year may have been prevented in year 6 girls alone.

Despite the successes of the levy, the UK is still in the grip of an obesity crisis and the roll out of HFSS is one of the ways in which the Government is attempting to loosen its talons.

HFSS was introduced October 2022 and imposed store placement restrictions on products falling within this category. Future restrictions on the promotion and advertising of HFSS products are also due to be implemented, but these have been delayed until 2025.

So far with the current restrictions in place, it’s been estimated by IGSs that 66% of customers haven’t noticed a difference in store. And while some consumers have seemingly welcomed the ban on volume promotions set to come in – 37% according to Mintel’s figures – the impact of this additional ruling may not be as momentous as once thought.

In January 2019, products deemed as HFSS sold through volume promotion stood at 10.1%, Kantar data states. Today, that has dropped to 4.6%, with the data firm suggesting that even with the introduction of mandatory rules, this indicates a much less “profound” impact in the future.

It’s also worth noting that out-of-home hasn’t really been impacted the same way as retail – perhaps it’s worth asking how many calories are in your average takeaway? Alcohol has also seemed to escape the clutches of policy, despite being very calorific.

The delay of price promotion (such as multibuys) restrictions resulted in a mix of relief and disappointment from the sector – with some retailers pressing ahead regardless.

As reported at the time by Food Manufacture, Action on Sugar and Action on Salt’s chairman, professor Graham MacGregor, called it a complete contradiction of the Government’s levelling up positions.

While the Food and Drink Federation (FDF) were much more open to the postponement, suggesting that it was a prudent move at a time of high inflation. The association had previously condemned the ruling, suggesting it will have a negative impact on the industry, so this response is unsurprising.

“The Government’s own estimates suggest businesses across the country will be hit by costs of over £1 billion a year – while the measures are not expected to impact rates of obesity,” chief executive Karen Betts said at the time.

Danone has very much been in favour of the HFSS rules and among its commitments has pledged that at least 90% of its portfolio of products by sales volume will not be HFSS. It has also promised never to produce a product for children which is HFSS.

“We believe the food industry has an important role to play in offering consumers those healthy choices,” Ellis said.

But Klinge is worried the rules won’t help with salt and that’s due to the aforementioned narrative around salt and flavour.

“If somebody actually does bother to look front of pack, they're going to choose something based on calories, sugar or fat,” she contended. “They're not going to worry about the salt content.

“We’ve been doing the same thing for a very long time and it’s not making the slightest difference.

“We have to flip the script. The food industry can have a positive impact on health, and we as food manufacturers have got the ability to be trailblazers.

“We've always believed that we should educate the consumer, allowing them to make their own choices.”

Ellis agreed that education is an important part of the health journey: “Contributing to health goals isn’t just about reformulation, product information and education can also help consumers make an informed choice. This year, our Alpro range underwent a visual identity update, whereby the nutrition and health credentials of our Alpro products were enhanced, particularly on the front of the label. This is to make it easier for consumers to navigate and differentiate between plant-based products.”

But from speaking with industry representatives anecdotally, it also seems that policymakers need educating too, to understand that different commodities have limitations and reducing the sugar, fats and salt in chocolate, for example, is not easily achieved.

It’s also worth noting that there has also been little recognition for producers making strides in reformulation unless it hits those very narrow targets of what constitutes as non-HFSS. It begs the question; do we need a more granular process that acknowledges these milestones?

Overall, whilst we have seen policy makers assessing ways to crack down on obesity, it’s clear to see that reformulation has really been driven by the consumer wanting healthier products. As they say, the customer is always right.