News

Supermarkets must re-evaluate how they work with their supply chains to bring food inflation down, says expert

Supermarkets should be investing more strategically in their supply chains to bring food inflation down, contends international procurement and supply chain management consultancy INVERTO.

UK food price inflation was among the highest across G7 economies in March 2023, second only to Germany. Although food inflation has begun to ease in Britain in the year to May 2023, it remains stubbornly high at 18.4%.

According to Sushank Agarwal, managing director at INVERTO which forms part of the Boston Consulting Group, many of the food products subject to high inflation rates tend to be those where supermarkets have traditionally only had “transactional” relationships with suppliers.

These products include:

- Eggs – 37% inflation

- Low fat milk – 33.5% inflation

- Cheese – 30.6% inflation

- Yoghurt – 23.4% inflation

Global food commodity prices declining

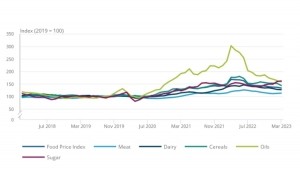

Despite high inflationary pressures, global food commodity prices are falling (see graph). The Food and Agricultural Organization (FAO) food price index has declined by approximately 21% from its peak early last year, although it remains around 33% higher compared with pre-pandemic levels.

Most food commodities have been on a downward trend since the second half of 2022, including cereals, dairy, oil and meats. The exception is sugar, which has seen a recent price hike.

There are a few reasons why this has not been reflected in consumer food price tags, including profit margins, import dependence and transmission lags.

Since 2021, food input prices have outpaced food output prices, which in turn have outpaced consumer prices, while the price of imported food materials has been rising at twice the rate of domestic food materials.

When it comes to transmission lags, relationships between farmgate, producer and retail prices are not immediate, with price shocks typically taking time to filter through the value chain.

Stronger partnerships between supermarkets and suppliers are needed

Agarwal explains that a re-think is needed if we are to see impact in food inflation for the better, claiming that the traditional transactional approach – based mainly on price with short-term contacts – means suppliers have been unable to invest in their business.

“Along with the effects of the war in Ukraine, geopolitical tensions affecting global supply chains and the UK’s labour shortage, the inefficiency of some food producers is the fourth major component of food inflation,” he said.

“Farmers cannot be blamed for not investing in automation and increased efficiency when they only had short-term contracts at minimal margin. That limited their ability to re-invest profits.”

He recommends supermarkets partnering with suppliers to deliver long term mutually beneficial relationships: “That means not only working with farmers to increase their yields, but also with their supply chain – packaging, feed producers, waste handling and transportation may all need to be addressed. Supermarkets should look at the entire supply chain as being in partnership with them.”

Dealing with a perfectly terrible mix

Meanwhile, supermarkets have been making moves to attempt to help those struggling financially, including Iceland which rolled out its Food Card Club – an interest-free loan that can be used in-store and online at Iceland.

Commenting in interview with Sky News earlier this week, Iceland boss, Richard Walker said supermarket loans were “a testament to how tough things are”.

“I don’t think in our 53-year history we’ve ever had such a perfectly terrible mix of different factors.”

Read our food and beverage 2023 market overview, summarising the key takeaways of the latest FDF State of the Industry report for Q1 2023.